On the latest SeedStories Podcast we sit down with Elizabeth Yin, a partner at 500 Startups who runs their Mountain View accelerator. Before joining Dave Mcclure and company at 500 startups, Elizabeth had her own adtech company LaunchBit acquired by BuySellAds in 2014. Before that, she spent time developing products at Google.

During the episode, we talk about bringing transparency to seed investing and what startups need to understand when they go to pitch her and other venture capitalists. We also get into how 500 Startups differs from other accelerators, along with its investment thesis.

We think you’ll agree that it’s a great chat with a ton of practical advice for startup founders on working with venture capitalists — especially at a seed stage level. So much so, we’ve pulled most of the transcript below for your reference.

Skip all the way down to the bottom of the page to play the audio! Or check it out on iTunes!

Enjoy!

SeedStories: Thanks for joining us today Elizabeth.

Elizabeth Yin: Thanks for having me.

We were just talking off-air and thought it would be an interesting time to catch up with you and 500 Startups. I know this week the 500 Startups batch from San Francisco is having their demo day. While you’re in Mountain View, I thought first I might just ask, as we approach demo day on Friday, are there any interesting trends that you see highlighted in this batch?

Certainly. For this batch, we have a number of FinTech companies, and we also have a number of health tech companies. I’ll dive into that a bit. I think that investors, in general, are going gaga for FinTech companies. I think there’s some substance behind it in general (Sarah Tavel wrote a great post on this). We’re in a time of interesting economics and there is a growing socio-economic divide.

There are problems with new grads trying to find jobs, and in general, although people are doing well, a lot of people are not actually advancing their socio-economics. As a result, what we’re seeing are a lot of ideas in the financial world that are helping with making things cheaper, if you will. We’ve invested in a bunch of ideas that are related to either banking, or loans, but even in other consumer products where the end result is that the consumers get a better and a cheaper experience, that’s actually something that we’ve invested a lot in. That’s one high-level theme.

Just curious with you saying that, are you also seeing interest or demand in HR focused startups that are helping people maybe increase their income because of that?

That’s interesting. In terms of pure HR, B2B software solutions, we’ve definitely invested in a number of those. Many of them don’t really touch upon this thing that I’m talking about, but in general, I would say in this area of FinTech that I’m talking about, ideas that help people make more money are certainly along these lines. I think Uber is probably the most famous example.

They’re not a portfolio company, but you can get a job on Uber and it’s very flexible. We’ve invested in other ideas, similarly, from that perspective. Then of course, from the loan side of things, if you can borrow money, or get a better deal on money, or get access to more capital more easily at cheaper prices then that’s something that’s very interesting as well.

Outside of FinTech, any other markets that you’re looking at in this batch?

In this batch, we also have a strong group of, what I call health tech companies. These are companies that are in the area of health if you will. It ranges a bit. There’s one company that helps you find a dentist based on cost. A lot of people actually don’t have dental insurance, and if you just go into any random dentist they often won’t tell you what the cost is. You get your procedure done and then you get hit with the bill if you don’t have insurance. What they’re trying to do is actually bubble up cost as a way to sort for things. Also, there are arbitrage opportunities, like people actually do fly to other geographical areas to get cheaper dental work. If you’re talking about a root canal or some major crown or something, it may be worthwhile for you to spend a couple hundred dollars flying somewhere else. That’s sort of a similar theme in health tech; trying to get people access to better care for cheaper even.

In terms of the work that you’ve done in Mountain View and moving to the office that you work within, are there certain areas that you’re naturally attracted to in terms of investment opportunities? Is healthcare something? I know you worked at Google for a while, and you had your own startup. I’m wondering if any of your past experience influences the directions you’ve invested?

I’d say at 500 Startups the way we invest is very much in a broad, diverse spectrum. For me personally, per my background, I do tend to gravitate towards more B2B ideas, and in particular, marketing tech, sales tech, ad tech. Just because those are areas that I know. That being said, my colleagues span the gamut on everything else. We have pure consumer investors, and we have other B2B investors who look at other areas. I think as a team, we end up investing in a lot of different types of businesses, but for me personally, that’s primarily what I look at.

Recently you wrote a piece that looked at how seed investors benchmark different startups, and you compared across these different industries and whether it’s a super high-tech company, and enterprise type company, or maybe even a consumer app, consumer-driven company. Can you talk a little bit about in terms of how you look at the opportunities for companies that find themselves in these different spaces?

Yeah certainly. As an entrepreneur, I certainly had no idea how investors benchmark startups. Now on the other side of the fence after being at 500 Startups for two years, and talking with a lot of investors both here as well as outside of 500 Startups, like all the who’s-who on Sand Hill and all the newer micro-funds, it became pretty apparent to me that, actually, there are these general buckets of categories.

There are four that I outline in the post that you referred to. Essentially, pure consumer, companies that don’t monetize right away; really high-tech, like the tech is so hard to do; infrastructure based plays, like maybe you’d need to navigate FDA regulations, or if you’re setting up a bank you may need a license or need to jump through other hoops; the last is probably the largest category and those are companies, either consumer or B2B, that make money right out of the gates. Those are the four categories that I outline in the post and they’re all looked at very differently.

I think that it is important as a startup, for you to understand what category you’re, more or less, thrown into, and then on top of that, once you know what category you’re in, it’s nice to know how you’re being judged against other startups. For example, if you’re in the pure consumer category, people don’t care if you’re making money. People also don’t really care about your team backgrounds at all. If you look at founders of successful fast growth consumer companies, whether it’s Facebook, or Pinterest, or Snapchat, or any of those, there isn’t anything in particular where those founders had domain expertise in those social networks or whatever that they built. In that category, really, you’re just being benchmarked on your growth against all other companies in that category. It isn’t like that for the other categories at all.

On the consumer side, I’m just curious, I know obviously the app store has kind of become overrun, where there’s so much choice for consumers. Are there new directions that you’re looking in terms of consumer tech companies? I know a lot has been made of bots this year, whether it is on Facebook or if it’s directly via SMS. Are there other areas that you’re looking at direct to consumer businesses for innovation?

In the pure consumer category, I would say 500 Startups actually doesn’t do a whole lot. We tend to prefer companies in the other three categories. I would say actually most investors when they are looking to invest in a pure consumer company, they don’t come in thinking, “Oh, this is how you build a company with these strong viral loops or…” I don’t think most investors come in thinking about how to do it, I think it’s more opportunistic, like “Oh my god, this company is growing so fast, I’m going to throw in a check. I don’t know how they’re doing it, but who really cares.” That’s kind of the perspective that a lot of investors have on this. I think the exceptions are the firms that really specialize in pure consumer investing. Maven Ventures in one of those, where the founder has actually grown successfully a lot of pure consumer companies himself. For everybody else, I don’t think they think about strategically how that happens for that category as much as some of the other categories.

Talking about that investment thesis, can you talk to us about how your 500 Startups investment thesis differs from other VCs, in terms of other VCs may look at forty investments and they just want one moon shot, you’re doing it at a much larger scale. How do you differ versus traditional VCs, but then also some of the other incubators in the space like Y Combinator?

I kind of liken us to a Fidelity for startups, if you will. If you take a company like Fidelity, they have lots of different funds, and they have lots of different fund managers, and they have lots of different investors in each of those different funds. In a similar way, 500 Startups actually has lots of different funds; We have our main funds, one, two, three, and four, and we can invest in any software idea internationally on those funds, but we also have more specific funds. We have regional funds such as the Korea fund, the Japan fund, the Canada fund. We have a lot of geographical funds. Then we also have verticalized funds like the mobile fund for example, and we’re rolling out a few more.

Each of those funds, they all have different fund managers and they also have different LPs, investors in these funds. The accelerator, which I think is what a lot of people see as akin to either YC or TechStars, or Angel Pad, or any of those, I think on some level, they are our peers and we do run programs, but that is one piece of 500.

Certainly, for the 500 Japan fund, I would say that that is not really analogous to YC, TechStars, etc.

Then, diving a little bit more deeply into the accelerator itself, our accelerator we think differentiates itself from some of the other programs out there in that we really focus on customer acquisition. In fact, we’ve hired a team of people who are on our staff and paid here to help our portfolio companies in our seed program with customer acquisition, helping them with everything from, either doing ad-buys, to outbound emails, etc, while they’re in the program here. To that end actually, we don’t help companies with other things. We don’t help them with design, we don’t help them with UX, we don’t help them with engineering. I would say that other programs have sort of a different focus than we do.

Right, so I think especially on the marketing growth side, you guys kind of offer more there, especially where Y Combinator strictly focuses on product. That’d be correct, no?

Yeah. It (Y Combinator) has certainly had huge wins at earlier stages on the product-side for sure.

That makes sense. In terms of, also on the international side, you look at like a Y Combinator really focus on San Francisco. You’re very worldwide, no?

A lot of our companies in our portfolio overall are international, certainly, for the regional funds many of them are just strictly international, but even for the main funds, and even for the seed program where we bring in all the companies to the Bay Area. Typically about a third of the companies in the seed program to maybe forty percent or so are international, they’re far outside the U.S. They come here for the four months and then they typically go back, although some people decide to stay.

In terms of looking at exits, recently you guys were investors in Twilio, correct?

That’s right, yep.

Any other recent exits or success stories on the enterprise side you point to from 500 Startups?

We’re a relatively new fund so most of our mark-ups are not liquid, Twilio is probably one of the few exceptions. We’ve been around for six years. That being said, some companies to watch on the B2B side of things include companies like Intercom, Talk Desk, perhaps you’ve seen their billboards on 101 or whatnot. Those are probably the two that are much further along, and they were in earlier batches. I think that 500 Startups is a bit younger than some of either its seed program peers such as Tech Start and YC, who have been around for over ten years now and also we are definitely younger than many of the other seed funds. We’ll see what happens with the realized gains for all of these companies.

On a personal side, I was curious, you’ve worked at Google, the biggest player or one of the biggest players in tech, you started your own startup, now you’re on the investor side. I was curious personally, what are the things that you enjoy the most in each of those roles, or is there one thing that stands out that you were happy to get rid of when leaving any of those roles?

Well certainly for Google when I left I was happy to get rid of the politics and have not looked back since. I think certainly there are huge differences between being on the investor side and running a startup. Although right now I would say comparative to being at a Sand Hill VC — where it’s less hands-on and more about strict investing as opposed to coaching than where I am right now at 500 Startups — I do get to get my hands dirty on operational things with our companies. That being said, it’s still very different from running a company. I don’t have the highs or the lows as our portfolio companies do. That’s a huge change. I don’t know if one is better or the other, certainly I sleep better at night but also I don’t get the same highs. A win for a company is not my win.

I don’t really have any clear thoughts on that. I think a lot of people ask me if I’m going to return to the entrepreneurial side and I think right now I’m still learning a lot, especially learning a lot about how investors see things in evaluating companies. I think that actually has been extraordinarily helpful to me and I do try to pass on that knowledge to others if it’s helpful to them.

I caught the other day, I think it was in another blog post, you had said: “Startup ideas are a dime a dozen, you really have to stand out.” What does that mean to you when you say that?

Yeah. I think when I was an entrepreneur I thought our idea is fairly unique and actually as it turns out, it was not unique at all. Even ideas that actually are seemingly unique, after seeing so many pitches on this side of the fence, I think I’ve seen about twenty thousand or so, really there aren’t any ideas that are unique. Even if it is a unique idea, maybe there’s like one or two others that I’ve seen in a very similar vein.

When it comes down to it, VCs get inundated with pitches all the time and I had no idea. For me, I’m a relatively new VC so I’m sure I don’t even see as much stuff as, say even Dave McClure here at 500 Startups, or any other Sand hill VC who has been in the business for a long time and has a name. I’m sure I don’t even see that many, but that means that if you even just want to be able to get a meeting, for say twenty minutes of forty minutes, you have to be able to capture somebodies attention within seconds. That’s an unusual skill to have, and I think a lot of entrepreneurs don’t realize that and as a result, they don’t do what they need to do in the emails to really stand out.

If I’m a startup founder that’s approaching you with a cold email, are there three points that I should think about when sending that email? Whether it’s the format, but also what the context of what that email is?

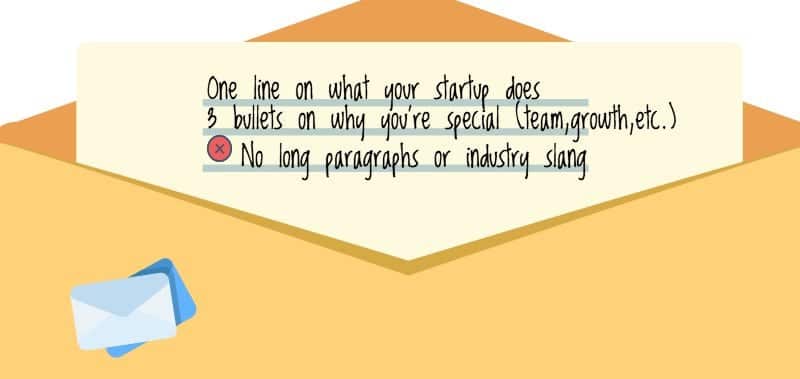

Yeah for sure. Format actually helps out a lot. A lot of people write these long paragraphs and frankly if you have so many emails to get through it’s just really difficult to read that. I try to, but I know a lot of investors ignore that. The simplest way is maybe one line about what your company does, like should be able to summarize what your company does in one line, maybe one line of context like “Hey, I’m raising a seed fund”, just very simple, and then maybe like three or a handful of bullet points of key things about your company. It could be that you have a really awesome team, like what specifically about your team is it that’s awesome. You could have really awesome growth, maybe its thirty percent month over month growth. Maybe you have great revenue traction, or maybe you have great pilot customers who have brand names. Whatever it is, put down the three to five bullet points that make your company really impressive. If you’re early, it could even be unit economics, like our cost to acquire a customer is ten dollars and right now we’re seeing lifetime values of twenty dollars. Whatever it is, it doesn’t have to necessarily be big traction, but whatever it is key interesting things that make you stand out. Then just one line of call to action, what’s the best way to chat for twenty minutes or so.

That’s really easy to read and digest and go from there. A lot of entrepreneurs, they have their key things buried. They don’t mention them, or it’s in a paragraph, or it’s at the end of their deck or something. Capturing attention quickly is extremely helpful.

Does a cold email versus a referral, is that any different in your category in terms of your interest or you look at the all the same?

It depends. There are some people who have consistently sent great deals and so any time they send me a warm referral I take it very seriously, but then there are a lot of people who will send you referrals like people you may not know very well, or they don’t know the company very well or whatever, just because that’s how things work. People ask for a referral, you say sure, and you just lob something over. I take referrals a little bit with a grain of salt, depending on who it’s coming from.

Cold emails I definitely look at pretty seriously because you just never know what you’ll find. Especially if the email is very clear and concise and somehow has laid it out like, “This is my company, bing, bang, boom.” Certainly, I’m going to treat it in the same way.

I think actually for entrepreneurs, yeah it would be great to get a warm referral and try to do so, but in parallel, I would just lob in a cold email anyway, and if they both get there at the same time, more power to you. No investor is going to think poorly of you for having two emails come in.

Once you decide to invest in a company, I know one thing I’ve seen with your tips is you often talk about how important speed of scaling is. Obviously having a team at 500 Startups that’s geared to growth re-illustrates that. Can you talk a little bit, just quickly, about what startups need to do once they find that product market fit, and then really say, “Oh, we’ve got to scale quickly.”

I think entrepreneurs need to actually think very deeply about what kind of business they’re trying to build. Venture capitalists are looking for a certain kind of business, but it doesn’t mean that that is the only kind of business that will be successful or is right. I think that’s actually where there is a lot of tension.

What venture capitalists are looking for is once you have product-market fit, or even for investors who will invest before product-market fit, they’re looking for speed of, essentially, customer or revenue acquisition, or if you’re a pure consumer company, user acquisition. Whatever it is, they’re looking for speed of growth on that front.

They’ll give you a bunch of money and the expectation is that they want you to use that money to buy all these ads, or do all this paid acquisition, or whatever it is that way you can really accelerate that.

That is actually why you see a lot of big flame-outs because companies do that and it doesn’t always work. If they didn’t have product-market fit, that’s not going to work. If you do have product-market fit then it may work, but even if you have product-market fit, very often that will saturate out at a certain point. You can do your ad buys, and then at some point, it won’t be profitable anymore and you’re still spending a lot of money there and maybe you flame-out.

That’s one of the problems with the VC model, and I think entrepreneurs need to consider that. That is the expectation that investors have of what they would like you to do with their money. I think the flip-side is I know plenty of startups who have bootstrapped, actually one of my mentors David Howser, who started a company called Grasshopper. That was entirely bootstrapped. For him it was all about profitable spend, and if a customer acquisition channel was no longer profitable, you move one and you try to figure out a new one, but they always operated under the idea that they didn’t have loads of money at their disposal.

I think that probably there is some happy medium in between, but that can be often a very difficult tension, depending on who your investors are.

That’s great advice. I guess kind of understanding what company you want to be. I caught in some of your posts this side project that you’re working on called rejectionathon, basically how to get founders over the fear of rejection. I was curious how you came about this and can you tell listeners what that is?

When I was an entrepreneur, I would I guess day one of running LaunchBit I knew that I needed to sell ads, but I wasn’t a salesperson by background at all, I studied engineering in college. When you’re a founder, somebody has got to sell. You’re either doing marketing or you’re doing sales, so somebody has got to do customer acquisition and so I had to start to learn to become a salesperson. In the beginning it was really, really scary, just calling these random people, and eventually, I actually got pretty good at it, but it took a few years. I was thinking there’s got to be a way for people to build a thicker skin short of doing a startup for a few years, so that’s why I started this event called rejection-a-thon this past summer.

It’s a one-day event, it’s sort of akin to how a hack-a-thon is for developers, in that rejection-a-thon is for business people to build a thicker skin. You get a list of challenges, they can be weird things like try to borrow fifty dollars from a stranger, or there are some simpler things like try to high-five ten people at a restaurant whom you don’t know. It’s really just, do these challenges to put you out there, get out of your comfort zone, and just get over your fear of being rejected and build a thicker skin. We’ve been doing a few of those events now, and we continue to do those. Our next one is in November, November 15th in the Bay Area. It’s just a really fun way to put yourself out there, build a thicker skin with a team of people.

Our next one is November 15th in the Bay Area. It’s just a really fun way to put yourself out there, build a thicker skin with a team of people.

I think it’s a really, really cool event because often people get labeled as type A or type B personalities so I think this is a cool way to break the mold and realize that you can be many different things.

So Elizabeth Yin of 500 Startups, thanks for joining us today. Anywhere we can find you online, I guess personally, and also 500 Startups?

There’s my blog at blog.elizabethyin.com, I also tweet @dunkhippo33, don’t ask, and 500 Startups URL is 500startups.co.

Thanks for joining us!

This transcript of our podcast conversation has been edited for length and clarity

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS