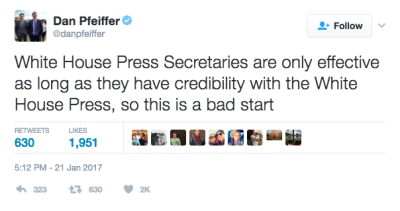

President Donald Trump kicked off his first week as POTUS in a curious way, sending his top PR guy, Press Secretary Sean Spicer, to defend the assertion that more people showed up to Trump’s inauguration than the media claimed. Spicer claimed that “This was the largest audience ever to witness an inauguration, period.” While a quick look at comparing photographs and other data would easily refute that, Trump and his people opted to double down.

In an interview that could very well become the defining moment of the administration, Kellyanne Conway, senior White House aide, told MSNBC’s Chuck Todd that Spicer didn’t lie, he simply provided “alternative facts.” Rather than quietly sweep the issue under the rug, Conway turned an egregious misrepresentation of facts into a blatant admission of lying. Because, after all, “alternative facts” is spin for LIES.

While this kind of communication has set a very scary tone for what’s certain to be an uber skeptical relationship between the Trump administration, the media and the American people, it raises a very important issue facing startup world: the unethical side of Silicon Valley.

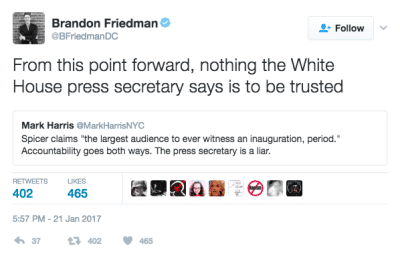

Simply put, when you are taking millions of dollars from people who expect to see enormous amounts of “momentum” and tell you to “break the rules” to get there, it’s not surprising that this type of pressure can result in some questionable practices.

While every industry is susceptible to fraud, the startup ecosystem has seen an influx of incidents recently that makes one wonder if we are merely seeing the tip of the “alternative facts” iceberg in SV.

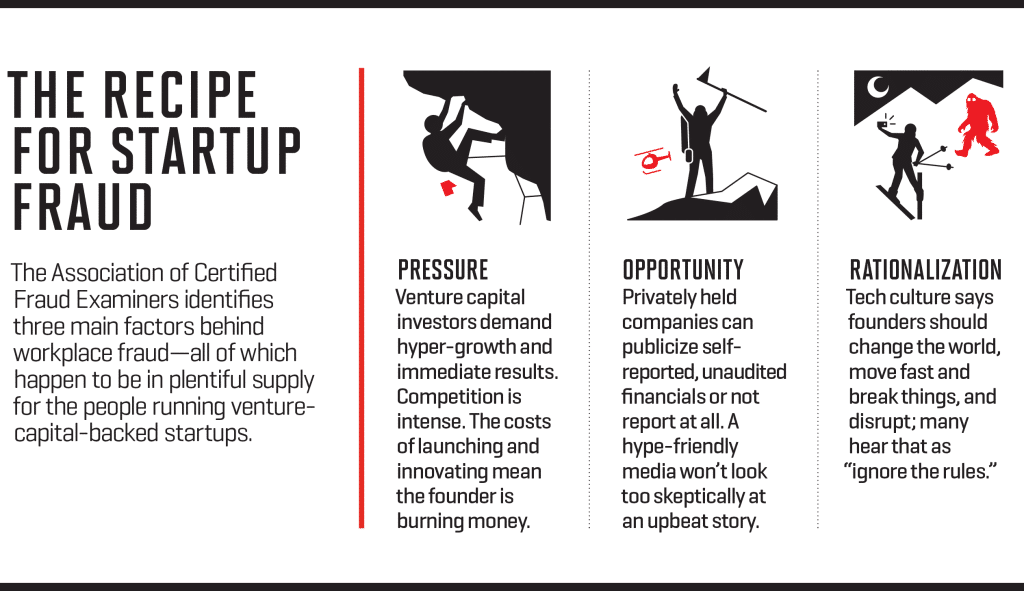

Last year, the Wall Street Journal exposed problems at blood-testing startup Theranos on a national level, efectivley taking down the much lauded company and its billionaire CEO. However, there have been numerous other cases recently where founders have apparently twisted, stretched and bent the truth in order appease those pumping the monetary blood through their veins.

Despite taking a significant hit in the media after reports of shoddy science and an FDA battle over misleading labeling, mayonnaise alternative, Hampton Creek (120m in 5 rounds), hasn’t seemed to get on the right side of the truth. The company is currently under investigation for its employees and contractors allegedly covertly buying its products from grocery stores for more than a year, as a way to make the product appear more popular to partners/investors.

Another example which recently made tech headlines is the story of Lily, a drone company that promised a simple to use drone that follows you and uses a camera to take great videos and stills. The product looked amazing and the company produced some great demo videos that helped it raise $15 million and garner $34 million in pre-sales.

However, in early January, the company sent an apologetic note to customers saying that they just couldn’t make the product and refunds would be offered. But how could that happen? With all that money, how couldn’t Lily turn their promising prototype into a product success? Well, it seems that the company had lied every step of the way, deceiving investors and customers a like. They had never actually had the prototype that appeared in the videos. Take a look at this note from one of Lily’s co-founders:

“Are you sure that the GoPro lens does not create a unique deformation/pattern on the image? I am worried that a lens geek could study our images up close and detect the unique GoPro lens footprint. But I am just speculating here: I don’t know much about lenses but I think we should be extremely careful if we decide to lie publicly.”

Clearly, they knew exactly what they were doing.

Maybe even more disturbing than these acts is the ways some investors seem to defend them. When the WSJ piece on Theranos came out some of Hampton’s most notable investors tweeted defenses against the one-sided “slam piece.”

Last winter, VC Vinod Khosla, an investor in Hampton Creek, didn’t take to kind to TechCrunch reporter, Jonathan Schieber’s, “Questionable” response to Kholsa’s assertion that Hampton was “doing awesome.” Khosla’s frustration was apparent when he continued, “I know a lot more about how they’re doing, excuse me, than you do.”

And this type of frustration may be shared more frequently amongst VC’s who continue to create enormous valuations in companies that will likely face extra scrutiny in the coming months. Last March, then Securities and Exchange Commission chair, Mary Jo White, traveled to Stanford to deliver a simple message to Silicon Valley: “We’re watching you.”

But then again, maybe not. The Trump administration has promised to be a boon for entrepreneurs and businesses and has expressed a desire to lesson regulations. Trump has nominated Wall Street lawyer Jay Clayton, no stranger to the startup world, having worked on high-profile initial public offerings such as Alibaba Group. Perhaps Trump, known to turn a blind eye to the facts, may promote the same misguided behavior in Silicon Valley.

Ultimately, who is responsible? The founder or the investor? While the onus is on Silicon Valley to come out and make it clear that “growth by any means” does not come at the cost of honesty, founders need to realize that if they feel pressured to stretch the truth in order to appease investors, than those are not the investors they need. Ultimately, those kind of relationships will only breed a future of dishonesty and likely lead to a very nasty death for their startup.

After all, honesty trumps growth.